Managerial accounting plays a crucial role in driving business efficiency and effective decision-making. It involves collecting, analyzing, and interpreting financial information to aid internal management in planning, controlling, and evaluating business operations. By implementing managerial accounting techniques, businesses gain insights into their financial position, performance, and potential opportunities to improve.

This article aims to provide an overview of the essential concepts and methods of managerial accounting, highlighting their significance for businesses operating today. We will discuss the main differences between managerial accounting and financial accounting, explore cost analysis and classification techniques, delve into budgeting and forecasting, evaluate business performance, analyze cost-volume-profit relationships, and understand how to use balanced scorecards as a performance measurement tool. All of these concepts contribute to the overall effectiveness of managerial accounting and can help businesses gain a competitive edge in the market.

Key Takeaways

- Managerial accounting involves collecting, analyzing, and interpreting financial information to aid internal management in planning, controlling, and evaluating business operations.

- The use of managerial accounting techniques can help businesses gain valid insights into their financial position, performance, and potential opportunities to improve.

- Managerial accounting techniques include cost analysis and classification, budgeting, and forecasting, evaluating business performance, analyzing cost-volume-profit relationships, and using balanced scorecards as a performance measurement tool.

- Understanding and implementing managerial accounting principles and techniques can significantly contribute to increasing business efficiency and provide valuable insights for effective decision-making.

- Through the application of sound managerial accounting practices, businesses can gain a distinct competitive edge in the dynamic marketplace.

What is Managerial Accounting?

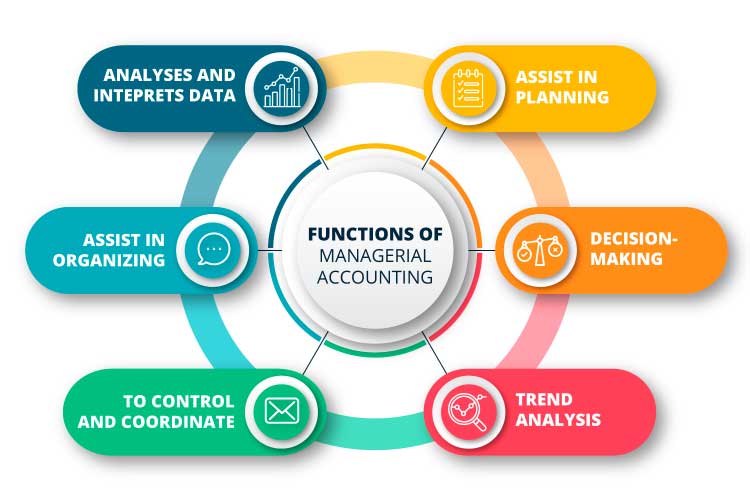

Managerial accounting is a specialized branch of accounting that focuses on providing financial information to internal users, such as managers, to assist them in making informed business decisions. Unlike financial accounting, which primarily deals with providing information to external stakeholders, managerial accounting is primarily concerned with the internal workings of a company and provides a more detailed view of a company’s financial status.

The purpose of managerial accounting is to provide managers with the information they need to make better decisions. This includes providing information on costs, revenue, profitability, and other factors that can affect a company’s performance. By using this information, managers can make better decisions about how to allocate resources, manage costs, and optimize operations. Through the use of various tools and techniques, such as cost accounting, budgeting, and performance measurement, managerial accounting helps organizations achieve their strategic and operational objectives.

Key Differences: Managerial Accounting vs. Financial Accounting

Managerial accounting and financial accounting differ significantly in their scope, purpose, and audience. While financial accounting provides information intended for external stakeholders, such as investors and lenders, managerial accounting is geared towards internal reporting to assist managers in making informed decisions to enhance business efficiency and profitability.

Some key differences between managerial and financial accounting include:

| Aspect | Managerial Accounting | Financial Accounting |

|---|---|---|

| Primary Users | Internal managers and executives | External stakeholders (e.g., investors, creditors, regulators) |

| Report Format | Internal reports can vary in format and content depending on the users’ needs | Standardized, externally audited financial statements (e.g., balance sheet, income statement, cash flow statement) |

| Timeframe | Future-oriented; focuses on planning and control of business operations | Historical; records past transactions and events |

| Accounting Principles | Emphasizes cost-benefit analysis; allows for financial flexibility and discretion | Follows generally accepted accounting principles (GAAP); prioritizes accuracy and consistency in financial reporting |

| Types of Reports | Budgets, forecasts, performance reports, cost analysis reports, variance analyses | Balance sheet, income statement, cash flow statement, statement of changes in equity |

Businesses need to understand and distinguish between these two types of accounting to ensure proper financial management and decision-making.

Cost Analysis and Classification in Managerial Accounting

In managerial accounting, cost analysis is a critical technique to help businesses understand and control their costs. This involves identifying and classifying costs based on their behavior, function, and relevance to decision-making.

Cost Classification

Costs can be classified into various categories, including:

- Direct costs: Costs that can be directly traced to a specific product or service

- Indirect costs: Costs that are not directly traceable to a specific product or service, such as rent and utilities

- Variable costs: Costs that vary with changes in activity levels

- Fixed costs: Costs that do not vary with changes in activity levels, such as rent

- Semi-variable costs: Costs that contain both fixed and variable components

Managerial Accounting Techniques

Various managerial accounting techniques are used for cost analysis and control, including:

- Cost-Volume-Profit (CVP) analysis: A tool used to determine breakeven points and make pricing and sales volume decisions

- Budgeting: A process to estimate and allocate costs for planned activities or projects

- Standard costing: A method used to compare actual costs to predetermined standards to identify variations and improve performance

- Activity-Based Costing (ABC): A system that allocates indirect costs based on the activities that drive them

Through cost analysis and classification, businesses can gain insights into their cost structure and identify opportunities to enhance efficiency and profitability.

Budgeting and Forecasting for Effective Planning

Budgeting is a crucial process in managerial accounting that involves creating a financial plan that outlines an organization’s expected income and expenses over a specified period. It enables businesses to anticipate and prepare for future financial needs, allocate resources efficiently, and monitor their financial performance against projections. Forecasting, on the other hand, involves using historical financial data to predict future outcomes and estimate the financial impact of various scenarios on the business.

One of the most common budgeting techniques used in managerial accounting is incremental budgeting, which involves making small adjustments to the previous budget period’s financial plan to account for changes in the business environment. This approach is gradual and ensures that budgeting remains focused on incremental changes, with little deviation from expected financial outcomes.

Budgeting and Forecasting Techniques

Other budgeting and forecasting techniques include:

- Zero-based budgeting: where the financial plan starts from scratch for each budget period, based on an analysis of the organization’s needs and potential revenue streams.

- Activity-based budgeting: This focuses on the organization’s various activities, their cost drivers, and how costs can be controlled and reduced.

- Rolling forecasting: where financial data is regularly updated to account for real-time changes and adjust the financial plan accordingly.

To aid in budgeting and forecasting, businesses also use a range of forecasting techniques to predict future financial outcomes accurately. These may include trend analysis, regression analysis, and data modeling, among others. The technique used depends on the type of data available and the complexity of the analysis required.

Managerial PlanningSuccessful budgeting and forecasting require effective managerial planning, where managers have a clear understanding of the organization’s goals and strategies and how these relate to its financial plan. It involves setting targets, developing action plans, and monitoring progress against targets. This ensures that the budget is closely aligned with the organization’s objectives and that resources are allocated efficiently and effectively.

By implementing robust budgeting and forecasting techniques and effective managerial planning, businesses can gain a competitive advantage and make informed decisions that drive growth and profitability.

Performance Evaluation and Variance Analysis

In managerial accounting, performance evaluation is a crucial process that measures the effectiveness and efficiency of various business activities and operations. Through performance evaluation, businesses can identify areas of improvement and develop strategies to optimize their resources for better results.

Variance analysis is a common technique used in performance evaluation, where actual results are compared to anticipated results, allowing businesses to assess their performance and identify the causes of any variances. By conducting variance analysis, businesses can determine whether their operations are on track, and if not, take corrective measures to enhance their performance.

Performance measurements are another essential aspect of performance evaluation in managerial accounting. These measurements provide businesses with a clear-cut understanding of their performance in key areas, allowing them to monitor their progress toward achieving specific goals and objectives.

In summary, performance evaluation, variance analysis, and performance measurements are vital tools in managerial accounting that help businesses assess their operations’ effectiveness and efficiency. By leveraging these tools, businesses can optimize their resources and achieve better results.

Cost-Volume-Profit Analysis for Decision-Making

Cost-volume-profit (CVP) analysis is a powerful tool used in managerial accounting to assist businesses in making key decisions related to pricing and sales volume. It involves calculating the breakeven point, which is the level of sales volume required to cover all costs and generate a profit.

CVP analysis provides businesses with insight into the relationships between costs, volume, and profits, allowing them to determine the impact of various factors on their financial performance. By using this tool, businesses can make informed decisions related to product pricing, sales volume, and cost reductions to optimize their profitability.

The breakeven analysis is a critical component of CVP analysis, as it helps businesses identify the minimum sales volume required to cover costs and achieve a target profit level. It considers both fixed and variable costs, ensuring that businesses have a comprehensive understanding of their cost structure and profitability potential.

Overall, cost-volume-profit analysis is an essential tool for businesses seeking to make effective decisions related to pricing and sales volume. By understanding their cost structures, breakeven points, and profitability potential, businesses can drive growth, optimize their resources, and maximize their profitability.

Capital Budgeting and Investment Analysis

Capital budgeting is a crucial aspect of managerial decision-making that involves determining the financial viability of long-term investment opportunities. It is the process of evaluating and selecting investment projects based on their potential for generating profits and increasing shareholder value.

Investment analysis, on the other hand, involves assessing the risks and returns of different investment options to determine which ones offer the greatest potential for financial gain. This involves analyzing financial statements, market trends, and other key metrics to develop a comprehensive understanding of the investment opportunity.

Together, these two concepts enable businesses to evaluate potential investments and make strategic decisions to optimize their resources. By adopting a rigorous approach to capital budgeting and investment analysis, businesses can minimize risk and maximize returns, enhancing their long-term growth prospects.

Performance Measurement through Balanced Scorecards

One of the essential tools used in managerial accounting for measuring business performance is the Balanced Scorecard. This method provides a holistic view of performance across various dimensions, enabling managers to assess progress towards achieving strategic goals, including financial, customer, internal processes, and learning and growth objectives.

Unlike traditional performance measurement methods that solely rely on financial data, Balanced Scorecards incorporate non-financial metrics to evaluate overall organizational performance. This approach not only ensures that important factors, such as customer satisfaction and employee engagement, are tracked and measured but also helps to identify potential areas for improvement.

Managers use Balanced Scorecards to identify how different aspects of their business are performing and to determine if corrective actions are necessary. This tool provides a clear and easily understandable overview of the company’s performance, making it an effective tool for managerial reporting.

In addition, the utilization of a Balanced Scorecard encourages communication and collaboration among departments toward achieving common goals and objectives. This enables organizations to work toward a shared mission and increase overall business efficiency.

Overall, Balanced Scorecards provide significant benefits to organizations by facilitating performance measurement and managerial reporting. By focusing on multiple dimensions of organizational performance, this method highlights areas that may require improvements, increasing the effectiveness and quality of managerial decision-making.

Conclusion

In conclusion, managerial accounting plays a vital role in driving business success, providing valuable insights that enable organizations to make informed decisions and optimize their resources. By implementing effective cost analysis and classification techniques, businesses can better understand their costs and identify opportunities for improvement, while budgeting and forecasting tools enable effective planning for the future.

Performance evaluation methods such as variance analysis and balanced scorecards provide businesses with a holistic view of their performance across multiple dimensions, enabling them to identify areas for improvement and make strategic decisions related to pricing, sales volume, and investment.

By leveraging the principles of managerial accounting, organizations can gain a competitive edge in today’s ever-changing business environment. Understanding the key differences between managerial and financial accounting is essential, as is being able to evaluate potential investments and make informed decisions to optimize resources.

Incorporating these techniques and strategies into your business operations can help drive efficiency, reduce costs, and improve performance, ultimately contributing to the long-term success of your organization.

Overall, the concepts and principles of managerial accounting are critical for effective decision-making, enabling businesses to stay competitive and adapt to the challenges of the modern marketplace.

FAQ

What is managerial accounting?

Managerial accounting is the process of collecting, analyzing, and interpreting financial information to assist managers in making informed decisions for the internal operations and management of a business.

How does managerial accounting differ from financial accounting?

Managerial accounting is focused on providing internal financial information to managers for decision-making, while financial accounting is concerned with providing information to external stakeholders, such as investors and creditors, for decision-making and reporting purposes.

What are the key differences between managerial and financial accounting?

The key differences between managerial and financial accounting include the type of information provided, the audience served, and the frequency of reporting. Managerial accounting focuses on providing detailed, timely, and specific information to internal managers, while financial accounting focuses on providing standardized, historical financial statements to external stakeholders.

What is the purpose of cost analysis in managerial accounting?

Cost analysis in managerial accounting aims to understand and control costs within a business. It involves the examination of different costs, such as direct costs, indirect costs, fixed costs, and variable costs, to determine their impact on profitability and inform decision-making related to pricing, production, and resource allocation.

How do budgeting and forecasting contribute to effective planning in managerial accounting?

Budgeting and forecasting in managerial accounting play a crucial role in effective planning by providing a financial roadmap for the future. By setting goals, creating budgets, and making accurate financial predictions, businesses can allocate resources efficiently, identify potential areas of improvement, and monitor their financial performance against the set targets.

What is variance analysis in managerial accounting?

Variance analysis is a technique used in managerial accounting to compare actual financial performance with the budgeted or expected performance. By analyzing the variances, such as favorable or unfavorable deviations from the budget, businesses can identify areas of concern, assess the reasons behind the discrepancies, and take corrective actions to improve overall performance.

How does cost-volume-profit analysis support decision-making in managerial accounting?

Cost-volume-profit (CVP) analysis helps businesses assess the relationship between costs, volume, and profits to make informed decisions. By analyzing the breakeven point, contribution margin, and profit levels at different levels of activity or sales volume, businesses can determine the most profitable pricing strategies, assess the impact of cost changes, and evaluate the feasibility of new products or services.

What is capital budgeting in managerial accounting?

Capital budgeting is a process used in managerial accounting to evaluate potential investments or capital projects. It involves analyzing the financial feasibility, expected returns, and risk associated with different investment options, such as purchasing new equipment, expanding facilities, or launching new products. The goal is to select projects that maximize the value and long-term profitability of the business.

How does a balanced scorecard contribute to performance measurement in managerial accounting?

The balanced scorecard is a performance measurement tool used in managerial accounting to assess business performance across multiple dimensions beyond just financial indicators. It considers non-financial aspects, such as customer satisfaction, internal processes, and employee learning and growth, to provide a more comprehensive and balanced view of the business’s overall performance.